Investors

Investors

LIONSCOVE offers a consistent annualized fixed-income return by investing in real estate debt. Historically our returns have been in the 7-9% range*, exceeding competitive offerings.

iNVESTING

Our Offering

Our team’s personal experience investing in the same type of projects as our borrowers allows us to make prudent decisions on which projects will be successful and those which won’t. With LIONSCOVE, you can relax and live the life you desire because you know that your money is safe and your investment will continue to grow.

Who we lend to

We lend to real estate investors who need short-term financing. They don’t go to a traditional bank because: it takes too long and there is too much red tape; there is a construction element to the project and achieving bank financing for an investment project with construction is challenging; they are self employed and the deductions they claim on taxes may it so they typically don’t qualify. There are several types of scenarios that we typically lend on:

When an investor purchases a property, remodels the property to add value, and then sells it.

When an investor purchases a property, remodels the property to add value, rents it out to a long-term tenant, and then refinances the loan with a long-term loan at a lower interest rate.

When an investor has a property or purchases a property where the zoning allows for additional units to be built on the existing lot. They build the additions and then either rent them out and refinance or partition them off to be sold.

Investors start with undeveloped land and work to build a building(s) on the lot.

When an investor needs quick access to capital for a short-term opportunity, such as buying a property at a significant discount but needs to close in 2 weeks or when anticipated financing falls through, and a security deposit is on that line that could be lost if they don’t close.

Know that when you come to us,

you come to Family.

How it works

01.

Reach Out

Submit application with basic information. Once we confirm you meet our requirements, you may get an invite to join the fund.

02.

Attend

Join us for an exclusive event such as a golf outing, happy hour, a day at the vineyards, or dinner to learn more about what we do in a casual environment.

03.

Personal Meeting

Sit down with LIONSCOVE for a 1:1 meeting to determine if this opportunity is right for your investment portfolio and your investment plans.

04.

Commit

Begin to Create Your Legacy by investing with LIONSCOVE.

Why choose Lionscove

Better returns

LIONSCOVE provides a higher fixed-income return than the market.

Inflation is eating away at cash positions, bonds have been at historically low levels, and the indices of mortgage REITS have declined in value over the last five years.

Meanwhile, LIONSCOVE has continued to provide consistent returns to investors that outpace even our direct competitors. We can do this because we aren’t greedy, and we put more of the income into the LIONSCOVE fund for the investors’ benefit that our competition keeps for their owners.

Less risk

Begin to Create Your Legacy by investing with LIONSCOVE.

LIONSCOVE carries less risk than the market and is safe like the bank.

We generate these risk-mitigated returns because we start with a robust due diligence process when reviewing all loan opportunities as a direct result of our personal experience as borrowers ourselves. The process continues by having strong guardrails to avoid concentration risks and diversification strategies to limit any downside impacts.

Unrivaled transparency

We provide all deal-level info, including all of the signed loan documents, via a shared site that is available at your fingertips.

We also share a summary of every loan in the portfolio and all the salient facts in underwriting the loan so that you can see what we are investing in, down to the specific addresses, loan amounts, credit scores, etc., at any time.

We are not aware of anyone in our industry who provides this level of transparency. Furthermore, we provide detailed audited financial statements for your review that our PCAOB-compliant auditor compiles. We don’t cut any corners, and we ensure that you have the information readily available to hold us accountable to that.

The bottom line is that we are so confident in our approach and the work we're all doing that we guarantee that if you don't receive a return, LIONSCOVE doesn't earn any fees.

What happens if a loan becomes delinquent or non-performing

01.

Reach Out

We work with borrowers based on their unique situation to bring them current, modify the loan or work with them to refinance or sell off.

02.

Foreclose

Sometimes we cannot reach agreement with the borrower and we need to foreclose. Most of our loans are in non-judicial foreclosure states which takes about 6-9 months to complete.

03.

Prepare

The most common result of foreclosure is that we own the underlying property. Knowing this we begin to prepare early in the process to take the necessary steps to be able to maximize return.

04.

Maximize Return

Through either immediate sale, minor rehab or full-scale rehab of the property, we are putting investor interest first by evaluating how to best align with our investment mandate while also maximizing return for investors.

What others say

Our Requirements:

We have stringent qualifications for all those looking to invest with us, and not everyone will be accepted. But once you’re in, you will benefit from best-in-class, personalized service that is unmatched in the industry.

SEC guidelines for an accredited investor: https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor)

$100k investement that is achieved over 12 months

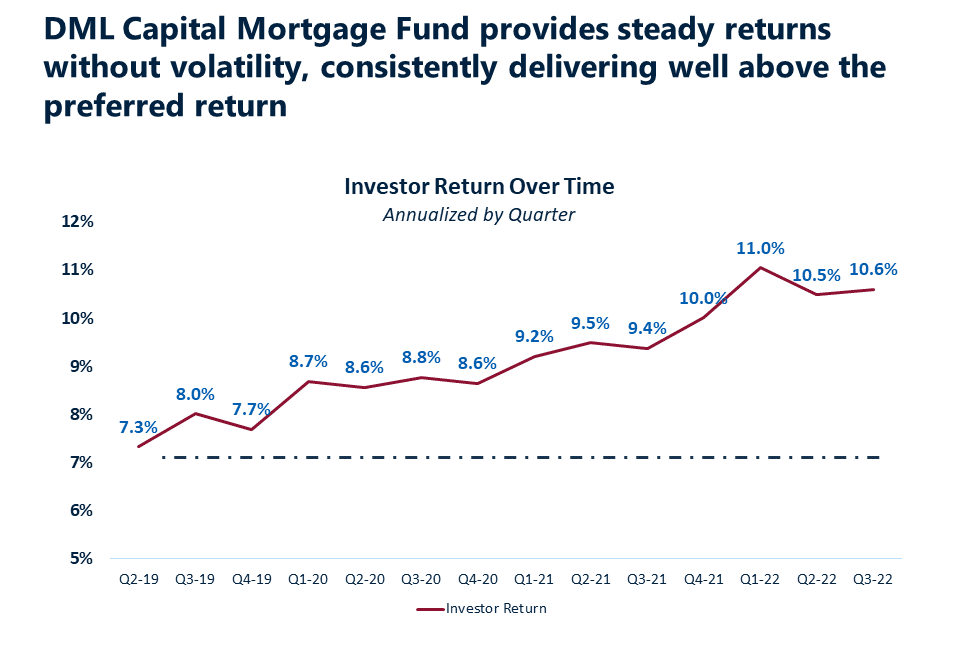

Our historical returns for Class A investors:

Ready to get started

Submit basic info so that we can confirm you meet our requirements. (Less than a minute)